Capex network investments

March 2019

Smart Capex team

Emerging technologies lift barriers to implement a comprehensive approach to Capex network investments. With announcements of investments in fiber accounting for billions, and millions of homes still to be connected, the fiber wholesale model has become a new trend in the European telecom market. For players such as Cityfibre, Open Fiber and SFR FTTH, fiber continues to be an attractive investment opportunity, as it enables broadband retail services and will be the backbone of densely-connected 5G networks.

Capex network investments: High Competition amongst incumbents

To secure a winning position on the market, each player needs to optimize every investment decision. While cost structures inform most of the planning today, it is the combination of accurate predictions of both costs and revenues that will ensure the profitability of future networks. Considering the scale of the investments to be made, the number of dimensions to consider has reached a new level of complexity (where to invest first, economies of scale on clusters, choice of technology architecture, …). This makes fiber wholesale investment cases too complex for standard Excel models. The most advanced operators are already looking into machine learning and AI to enhance human intelligence.

Wholesalers face specific challenges

Wholesalers are financially driven organizations, and they focus mostly on costs. Most fiber wholesalers have been planning investments under a top down approach (using aggregated information), while efficiency gains lay into a granular, bottom up, optimization.

This exercise is already complex for traditional, commercial operators but wholesalers face additional challenges, namely:

- Limited proprietary consumer data

- Higher reporting standards

- Lack of experience with advanced analytics

- Potential future synergies with 5G and FWA

This article describes how emerging technology lifts such barriers and allows wholesalers to implement a comprehensive approach to capex network investments.

1. Limited proprietary consumer data

Many wholesalers assume that they don’t own sufficient commercial data on their own to reach a higher level of granularity in capex planning. To increase granularity, wholesale operators can gain access to the required proprietary or open datasets, providing visibility on street-level socio-demographics, business universe information and competitive data in order to more accurately predict revenue and churn.

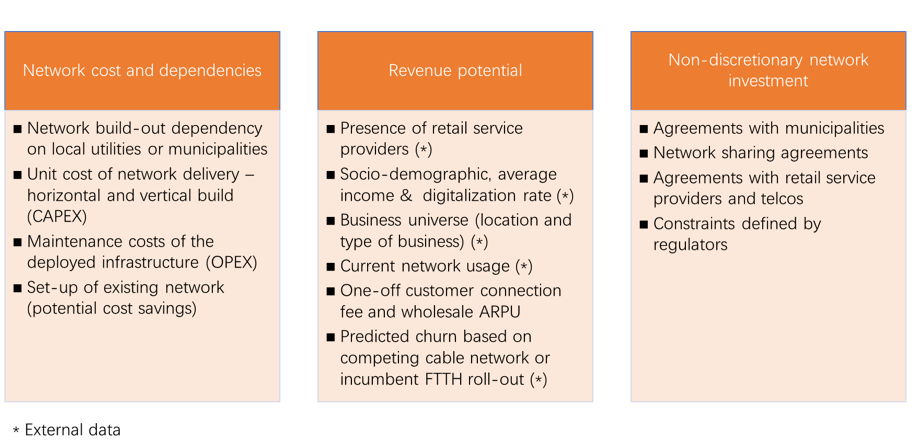

We have identified 3 types of data available to wholesalers:

- Network cost and dependencies

- Prediction of on-net penetration and revenue potential

- Non-discretionary network investment

Ingesting granular data has proven to maximize return on invested capital, thanks to the ability to rank and to cluster candidates all the way to a street level.

Indeed, an optimized investment plan for a customer case in West Europe resulted in 65% additional ROI compared to an initial investment plan based on national averages. For another case in Europe, the present value of revenues evaluated based on city-level data increased by 1.5% compared to an approach based on national averages. When looking at street level data, the uplift increased by 4%.

2. Higher reporting standards

Investment funds behind wholesalers typically have high expectations of return and expect accurate reporting on a regular basis. The caveat is that network CAPEX decisions are often based on one-off models. Rigid Excel tables make it hard to track actuals and update source data according to market changes. Knowing that a fiber investment plan roll-out lasts an average of 15 years, there is a high chance for errors. Today, new analytical tools exist to compare actuals with the initial plan in order to constantly optimize future returns. They will certainly be an asset in future investment waves. Timely benefit management generates transparency during the realization of the investment plan, and this transparency will keep investors happy.

3. Lack of experience with advanced analytics

Disruption often takes companies by surprise. There are numerous examples of corporations who failed to keep up with change. Network operators need to stay attuned to new technologies in their field. Today powerful algorithms put an end to guess work and sub-optimal revenue planning. Advanced analytics and machine learning open new avenues for incumbents willing to change the way they have been operating for the last decade.

Defining the optimal investment plan with advanced analytics requires a software solution that leverages numerous large transactional data-sources, enriches the data to compute a detailed profile of each investment candidate, uses predictive models to forecast the cash-flows associated with the investment, and then applies clustering and optimization algorithms to define the optimal list of investment candidates.

Then, as you often don’t find the perfect solution right away, analysts need to iterate through different scenarios and be able to integrate qualitative information in the final roll-out plan. You therefore need to ensure that your solution allows you to build and run these scenarios rapidly and calculate the value of trade-offs you want to integrate in your plan.

4. Potential future synergies with 5G and FWA

Today, networks still make use of microwave radio links for a significant proportion of connections. The transition to 5G requires fiber in the majority of base stations.

The collaboration between wholesalers and network operators will be critical to ensure that the right locations are being served at the right time. Speed of deployment will also be important to offer an attractive network on time.

But there are also opportunities beyond 5G. The potential to leverage the fiber network deployed for 5G as a backbone for Fixed Wireless Access (FWA) represents an additional avenue for future revenue generation. Therefore, requirements attached to future technologies at large should be considered when scoring the profitability of investment candidates.

Smart Capex has anticipated this need by allowing the inclusion of potential synergies between emerging technologies in business cases.

Conclusion

The analytics revolution has hit the telecom industry and is already disrupting businesses operations. Ignoring the risk of underserving a changing market could severely hurt the competitive position of even the biggest historical players. While network operators face the risk of becoming mere commodity providers, wholesalers can take a leap by focusing on their CAPEX plans. Thanks to existing software, prediction of revenue can be modelled on the most granular level. Using a combination of external and internal data sources results in a significant uplift of investment return compared to an approach based on national or regional averaging.

Wholesalers can also sharpen their position as true network specialists when anticipating future needs and mastering network prioritization.

Adopting a more digital business model will make wholesalers stronger in front of investors and partners needing accurate revenue prediction. In fact, the challenge lies less in being aware of a changing world than in embracing a different way to operate.

Since new tools and insights are already available, those that can act on them are the ones that will succeed.