Network investment decisions are among the most difficult for operators to address. According to GSMA, network operators are expected to spend 1.1 trillion dollars in CapEx infrastructure between 2020 and 2025, making CapEx optimization at the top of the agenda for telecom executives. With that number in mind, let’s explore some key lessons gathered from working 10 years with telcos on network CapEx optimization.

Network Performance ≠ Customer Satisfaction

Upon peering into the telco industry, it’s not rare to see the most advanced operators make foolish decisions. Examples can be found everywhere. They range from investments in desolate locations to those in areas where the population density is high, but consumption and purchasing power are low. Here’s why.

Multiple decision criteria are considered. In the past, investment decisions were primarily based on technical criteria such as network coverage. However, in recent years, the focus has shifted to the return on investment (ROI), which also depends on commercial data. Customer satisfaction is key—and it’s not necessarily linked to network performance. Depending on their location and activities (e.g., living in rural or urban areas), clients’ expectations can vary greatly, as can their corresponding level of satisfaction.

Decisions are made in silos. Depending on the available technology (fiber, cable, mobile), telcos often make investment decisions separately. However, it’s important to remember that a customer does not differentiate between the types of networks used. Whether they sit in their office, their car, or on the metro, the customer wants the best service possible. The challenge is to identify the locations where service improvements will lead to massively benefit these two areas: satisfaction and consumption.

Customer Value ~ Customer Satisfaction

We’ve established that customer satisfaction is key for telco investment decisions. Now, the main question remains: how do you measure that metric? Customer surveys may seem like the easiest way, but they are not the most efficient. Surveys are often costly and intrusive; even worse, the sample might not be representative of the true consumer base. Last but not least, a survey is a one-shot, static picture. Satisfaction is a constantly-evolving parameter, and there are better ways to measure it.

In fact, most of the data reflecting customer satisfaction already exist at the telco level – yet this information is available in hidden or underutilized data sources. Indeed, mixing and enriching data coming from call centers, network performance centers, and Call Detail Records (CDRs) allows you to track customer value and create more meaningful insights about customer satisfaction.

For example, you might initially believe that low network performance in an area populated with low-value clients is not an issue. But once you realize that high-value customers cross this area every day during their commute, you will likely decide to invest in that area. Due to this customer traffic, the expected ROI is, in fact, quite high.

ROI is the Driver for Dynamic Network CapEx Optimization

There is a third reason behind why foolish CapEx decisions are not uncommon. CapEx decisions are typically based on ROI projections that are not monitored afterward. Despite this, feedback loops are crucial in making CapEx optimization a dynamic process. Consider this scenario: you identify two areas with coverage problems. It’s possible that solving the problem in one area will positively affect the other due to the clients’ mobility patterns. In this case, closely monitoring ROI allows better resource allocation.

Capex management is obviously an optimization process. So, given technical and commercial constraints, how should the telco maximize ROI while minimizing CapEx spending over time? To find the answer, it’s important to realize that the telco itself has the responsibility to define its constraints, following its own strategic priorities. The balance between technical and commercial constraints is dependent upon the telco’s size, positioning, client base, and long-term strategic orientation. While one operator may place 90% of its focus on the Net Promoter Score, another may adapt network deployment to client mobility patterns. In contrast, a third might want the best 4G coverage on its market. Depending on the telco, each of these options could be beneficial.

The trick is to continually track customers’ value while collecting and analyzing ROI feedback. In effect, you must strive to make CapEx optimization a truly dynamic process.

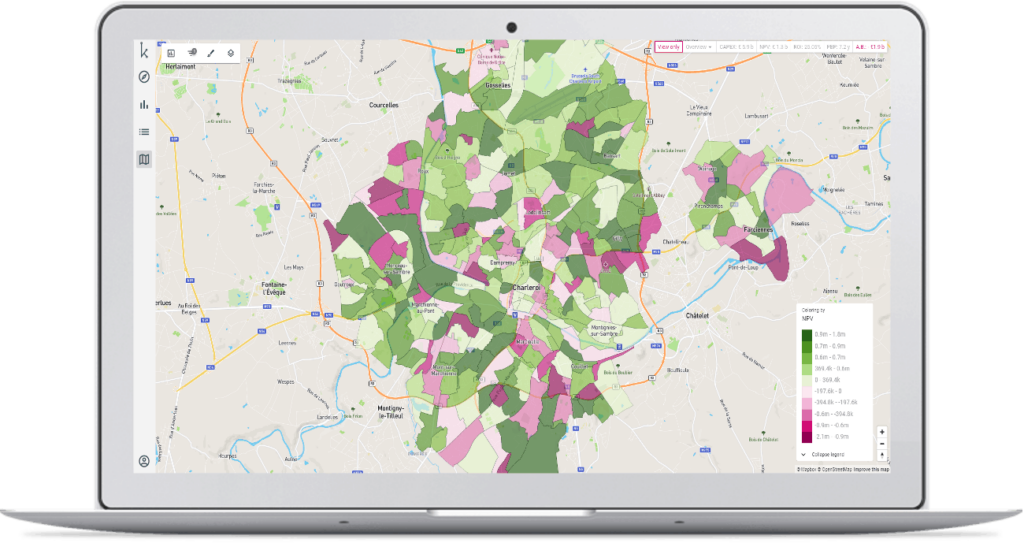

About Smart Capex

Smart Capex helps telecom operators select the optimal network investment candidates that maximise the impact of the entire plan while matching the operator’s commercial, financial and technical constraints. The CapEx efficiency gained can then be translated into overall budget savings or reallocated to other projects. Telcos around the world use Riaktr’s Smart Capex tool to manage their network capex. Reach out below for a demo.